Passive income can be an brilliant way to help you create additional cash flow. Whether you have a side hustle, business or are just looking for a little extra money each month. Passive income can help you gain more during good times and tide you over if you become suddenly unemployed or voluntarily take time off from work.

- If you’re worried about being able to save a little of your earnings to meet your retirement goals, establishing wealth through passive income may be appealing to you as well.

- With passive income, you can have money while still working your primary job.

- If you can build up a solid flow of passive income, you might want to relax a little.

- In either case, a passive income provides additional security.

If you’re an expert in this field. Here, you can turn your expertise into a valuable product or service for customers, such as design, software coding, etc. You’ll need an opportunity that wants a time or work investment, such as developing an influencer profile or other options. It’s a work-intensive chance at first.

You’re replacing your time for your lack of capital until you can raise enough money to broaden your set of options.

What is Passive Income?

Passive income is a form of income that doesn’t require much active effort to be earned. It allows you to make it even when you are not working and is an excellent source of extra income. However, it should be understood that it is impossible to get something for absolutely zero effort, and having a passive income is no different. Although a lot of work isn’t required, additional labour such as regular updates and maintenance of your resources along the way is essential to keep your passive wealth consistent.

- Revenues from a rental property, limited partners, or other businesses where a person is not actively involved are examples of passive income.

The Internal Revenue Service (IRS) has explicit rules for determining whether a taxpayer has actively participated in a business, rentals. Or other income-producing activity, known as material participation.

When used as a practical term, passive income is defined by the IRS as “net rental income”. Or “income from a businesses or firms in which the taxpayer does not materially participate” and can include capital gains in some cases.

- A taxpayer can deduct a passive loss from income earned from passive activities.

Income is classified into three types: active income, passive income, and portfolio income. Limited partnership, Earnings from a rental property, or other business in which a person is not actively involved—for example, a silent investor—are examples of passive income.

Passive income is defined as money and losses generated by a business in which a person is not actively engaged. A few examples are property rental (provided real estate isn’t your line of work), equipment leasing, and limited partnership interest.

Prominent Ideas to Help Generate Passive Income

Here is a list of some great ideas you can use to earn passive income straight from the comfort of your home. Your only requirements are a PC and a strong internet connection.

- There is no “one size fits all” advice for enhancing income streams.

- The number of income bases you have should be determined by where you are financially and what your financial goals and objective are for the future.

- However, getting at least a few is an excellent place to start.

If you have little or no money, to begin with, you’ll have to rely primarily on your own time investment to get you through until you can save up some money. This entails concentrating on passive income sources that take advantage of the various characteristics.

The covid-19 pandemic has dramatically affected people’s lifestyles and the way they work. Many people lost their jobs, and many still find it challenging to make both ends meet. Income diversification is therefore getting increasingly popular. It has made it possible to experiment with new ideas, but it has also served as a backup plan if anything goes wrong. Here, we will look at ways to diversify your income and earn some extra cash at the end of the day.

There are only 24 hours in a day is one of life’s few constants.

- If you take on a part-time job, including being a ride-share or food-delivery driver, you will have less free time for other activities.

- It also doesn’t make sense to diversify your income if the attempt costs you your full-time job and you rely on that income to make ends meet.

- Ensure that the additional demands of your passive business operations do not impair your job performance or jeopardize your health.

Restructure your effort distribution regularly. You’ll want to rebalance your “portfolio” of income sources as part of your diversification process. If you discover that one source is more financially viable than the others, you should devote more time. If one source consumes much more of your time, you may want to discontinue it entirely.

1. Online Paid Courses

If you have proficiency in a subject or a skill people would like to learn, you can use it to create a source of passive income for yourself. It can be put on skill education platforms like Udemy, skillshare and you can also charge a fee for it. Collect all your ideas and knowledge to frame a course.

You can sell courses as an add-on to your existing business. For example, suppose you’re a blogger. In that case, you could offer a system that delves deeper into a specific topic area of your blog.

If you provide a service, you can create and sell an online course for people who would instead gain knowledge and do the work themselves rather than hire you.

Developing and trying to sell online courses can provide you with a steady income stream. You only need to create a curriculum once, and then you can sell it indefinitely.

Furthermore, because your course is online, you can have trainees from all over the world, in any time zone, with no extra effort.

Several new online course platforms are now available, making it easier to set up and sell your course. Furthermore, as technology advances, many of the tools and equipment required to create a study are very simple and produce professional-quality results.

2. Blogging

If your writing is good and you enjoy it, you can try blogging. A blog is an online information website that displays information in chronological sequence. It can be an exceptional cause of passive income for you. You can earn money from your blogs through ads and affiliate marketing. To make money through advertisements from your blog, focus on Search engine optimization to harness enough traffic to your website.

Affiliate advertising is one of the best ways to make money. A single sale is worth far more than a click on a contextual ad. It’s something that most bloggers use these days, and it’s one of the most profitable ways to make money from a blog.

Another gain of affiliate marketing is that you can use it on any blogging platform, including Wix, Squarespace, Medium, and even LinkedIn.

You have to share your unique affiliate link for the product you’re recommending, and when someone buys it, you’ll earn a large commission on the sale amount. Affiliate marketing is how many bloggers make millions of dollars.

3. Creating an App

If you are a programmer and application development is your specialty. There is nothing better than creating an app for some extra money. You can include in-app purchases and ads to earn a pretty good passive income.

We are all familiar with in-app advertisements regarding Supported Mobile Applications. Google and Apple both provide ad networks such as AdMob and iAds. However, to make a good profit from your free app offering, you will need a lot of traffic and downloads.

The app market is more substantial than it has ever been. While there appears to be a preference for free apps over paid-for products, there is still adequately of money to be made in the market.

Americans spend an average of 5 hours per day on their phones. This alarming amount of time, whether spent scrolling through their social media newsfeed, throwing poke balls or streaming music, represents a massive opportunity for app developers.

As per the global market study, worldwide mobile app earnings will surpass $100 billion by 2020, up from $75.8 billion currently (current). App revenues were only $8 billion in 2011 and are expected to reach $45 billion in 2015, representing a 500% increase.

According to these estimates, app store gross revenue could reach $100 billion by 2020. Some industry insiders predict that income will exceed $100 billion by 2020.

Sometimes mobile apps are available in both free and premium versions. When a free app is created, it includes a link that entices users to try it. To download the premium version of an app, a user must pay a one-time fee to upgrade to the premium app, which offers more features.

4. Stock Market Investments

Investing in stocks can help you earn a passive income far beyond your imagination. Although investing in stocks comes with risks, things can only turn too bad when you go beyond making calculated investments. Read annual reports, keep an eye on the business trends, and invest accordingly.

- The “four horsemen of tech”—a quartet of massive technology stocks (Microsoft (MSFT), Intel Corp. (INTC), Cisco Systems (CSCO). And the now-private Dell Computer) that fueled the rise of the internet sector and drove the Nasdaq to unprecedented heights.

- It helped popularise the buy-and-hold investment strategy in the 1990s.

They appeared to be such safe bets that financial advisors advised them to clientele as companies to buy and hold long-term. Unfortunately, many people who followed their advice bought late in the bull market cycle, so when the dot-com bubble burst, the prices of these overpriced equities also crashed.

However, virtually all investing involves some level of risk: it is always possible that the value of your investment will decline over time. As a result, one of the most important considerations for investors is how to manage risk to achieve their financial goals, if they are short-term or long-term.

Investing is defined as an act of perpetrating money or capital to an endeavor in the hope of earning additional income or profit.

Unlike consumption, investing save money for the future, hoping that it will grow over time. However, there is a risk of loss when investing is relatively higher than consumption.

The stock market is the most common way for new investors to gain investment experience. Investing is a current commitment of resources to a future financial goal.

There are various levels of risk, with some asset classes and investment products being inherently riskier than others.

5. Selling Images, E-books, and Designs Templates

If you are good at photography, you can sell your clicked photos in numerous ways online. You can either sell them directly by creating a website of your own or on various stock photo websites.

If you are a Graphic designer looking for some extra income, you can gain it by selling items such as mugs and t-shirts with your printed designs. You can do the same either on a website of your own or with the help of platforms such as Cafe Press and Zazzle. Although it may take you some time to find what the market is interested in and what is your target audience, things go smooth afterwards.

E-books are packaged information outlets you can create to sell a set of skills. It is a long and assembled form of text content and can quickly be built on Canva and MS-Word platforms.

YouTube allows you to connect to the world through video content. After getting enough views and followers on the platform, YouTube allows you to monetize your videos and make money out of them. Although it is a gradual process, it is adequate for a passive income.

The covid-19 pandemic has dramatically affected people’s lifestyles and the way they work. Many people lost their jobs, and many still find it challenging to make both ends meet. Income diversification is therefore getting increasingly popular. It has made it possible to experiment with new ideas, but it has also served as a backup plan if anything goes wrong. Here, we will look at ways to diversify your income and earn some extra cash at the end of the day.

There are only 24 hours in a day is one of life’s few constants.

- If you take on a part-time job, including being a ride-share or food-delivery driver, you will have less free time for other activities.

- It also doesn’t make sense to diversify your income if the attempt costs you your full-time job and you rely on that income to make ends meet.

- Ensure that the additional demands of your passive business operations do not impair your job performance or jeopardize your health.

Restructure your effort distribution regularly. You’ll want to rebalance your “portfolio” of income sources as part of your diversification process. If you discover that one source is more financially viable than the others, you should devote more time. If one source consumes much more of your time, you may want to discontinue it entirely.

Conclusion

The Covid-19 pandemic has pushed all of us to ensure financial stability ourselves. A passive income apart from our daily jobs can help us achieve that. Moreover, it gives us a chance to broaden our perspective. Explore the above ideas and find a way to earn money while you sleep.

Passive income involves rental properties, self-charged interest, and businesses. The person receiving the payment has no material involvement. For income to be considered passive, specific IRS rules must be followed.

The Internal Revenue Service (IRS) does collect taxes on passive income. This type of income is frequently taxed at the same rate as wages from a job, though deductions can sometimes be used to reduce the liability.

In recent years, the term “passive income” has been thrown around a lot. It has been used colloquially to define money earned on a regular basis with little or no effort on the part of the person having received it. Proponents of passive income are typically supporters of a work-from-home and be-your-own-boss professional lifestyle.

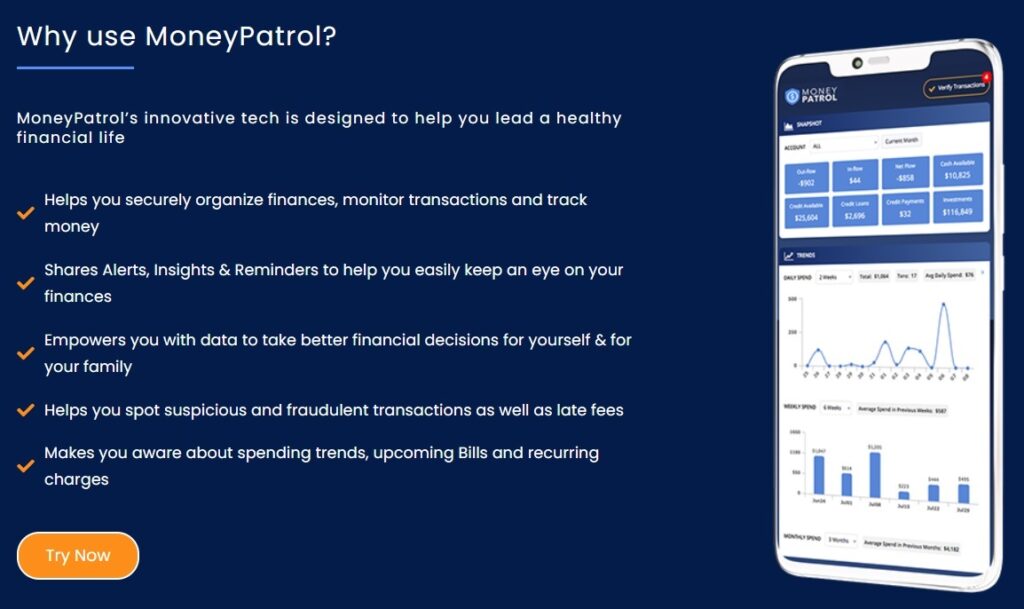

free budgeting app best free budgeting app budgeting app best free budgeting apps budgeting app free money management app manage money app family budget app personal finance tracker track personal finances budgeting app for couples

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances