Personal Accounting Made Easy, Accurate, Comprehensive

Accurately track your finances with MoneyPatrol — a powerful, comprehensive personal accounting system that lets you monitor your financial accounts, track income and expenses, manage your financial life, and reach your money goals. Stay organized, stress less, and gain confidence in your finances.

Stay On Top Of Your Finances With Confidence

Track spending, monitor accounts, detect fraud, and get insights to manage your money with confidence

Comprehensive Features And All-in-one Platform

MoneyPatrol is a comprehensive personal finance platform that covers every aspect of managing your money. From tracking income and expenses to setting budgets, monitoring bills, and generating detailed reports, MoneyPatrol provides all the tools you need in one place for comprehensive personal accounting.

Expense Tracking

Income Tracking

Budgeting

Bill Tracking

Debt Tracking

Business Finances

Reconciliation

Detailed Reports

Investment Tracking

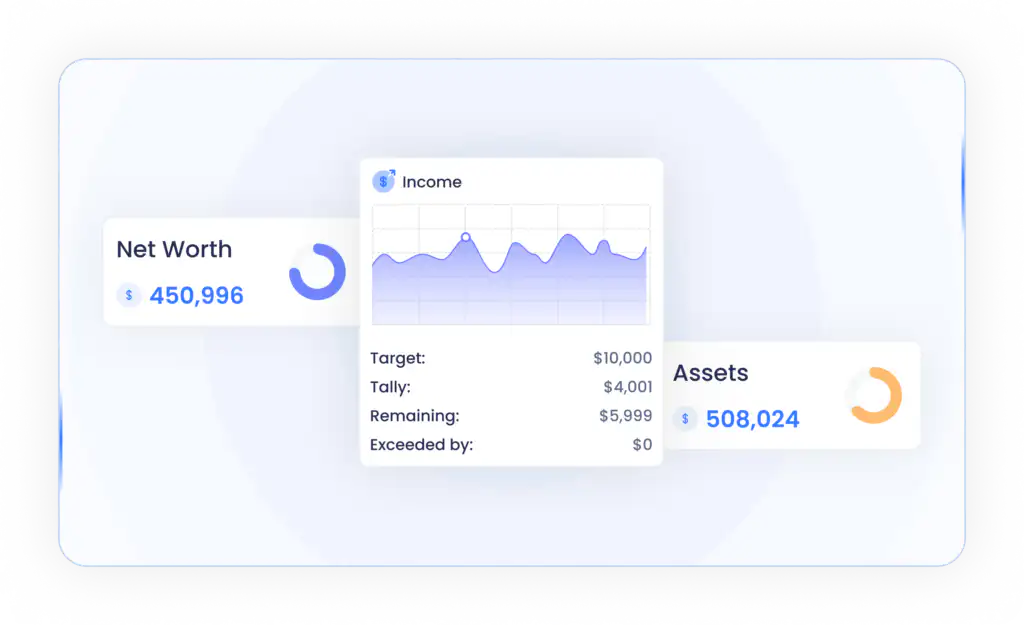

Net Worth Tracking

Credit Score Tracking

Receipt Tracking

MoneyPatrol Is The Best FREE Money Management Application

MoneyPatrol provides a comprehensive suite of tools and features that cover all aspects of personal finance management. From expense tracking to budgeting to investment management and bill reminders, MoneyPatrol has you covered. Our application is FREE with affordable plans offered for advanced features.

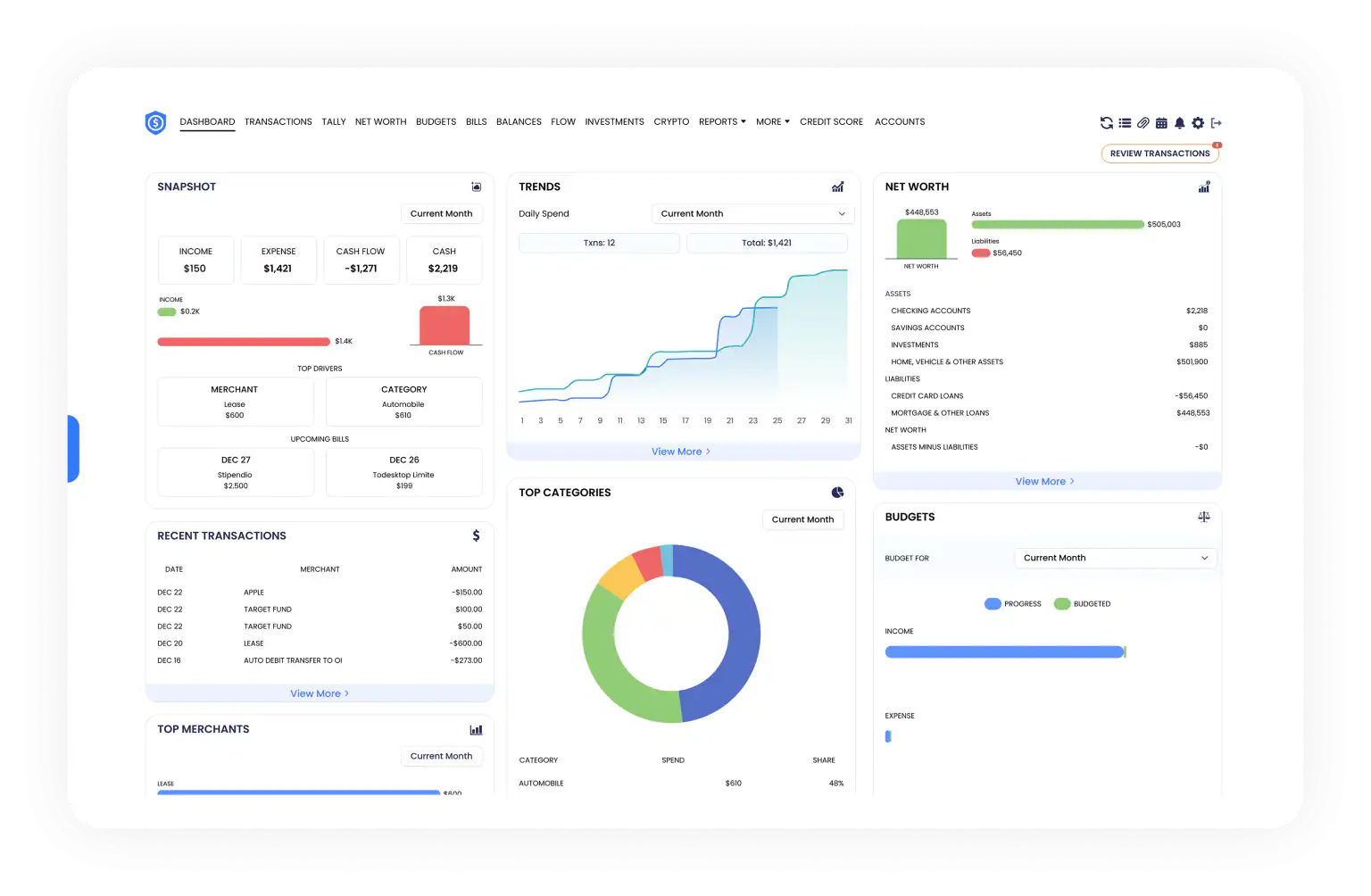

Get Your Own Personal Finance Dashboard

MoneyPatrol provides you your own personal finance dashboard to help you understand in detail your transactions, balances, debts, bills, loan payments and credit score. You can customize your dashboard and set up the views you want to focus on. You can even share the dashboard with your spouse or with your financial coach, advisors and CPAs.

Get All Your Financial Accounts In One Place

Get Key Features For FREE, Understand Your Finances

Why Use MoneyPatrol?

Who is MoneyPatrol for?

Working Professionals

Freelancers and Self-Employed Individuals

Families and Parents

College Students and Recent Graduates

Small Business Owners

Debt-Conscious Individuals

Investors and Savers

Retirees and Pre-Retirees

Couples Managing Joint Finances

People Who Want to Improve Their Financial Habits

Best-in-class data connectivity

MoneyTalks On Money And Personal Finance

01

01

MoneyTalk: Why You Should Create Budgets

Budgeting Apps are an effective way to help you spend your money the right way, by giving you a chance to plan ahead of time, pay off debts, save for the future and even have extra money for fun…

Read More 02

02

MoneyTalk: How Identity Theft Impacts You

Have you ever considered that you could become a victim of Identity Theft? When a criminal gets hold of your personal information, there are several things they can do with the data…

Read More 03

03

MoneyTalk: How To Increase Your Net Worth

Net worth is an important indicator of how you have been doing financially. A positive and improving net worth indicates that you have been doing a good job managing your finances, while a negative net worth…

Read More