USER GUIDE > DEBTS

This field allows you to keep track on your debts and determine how much you owe and how long it will take to pay off each account.

TABLE OF CONTENTS

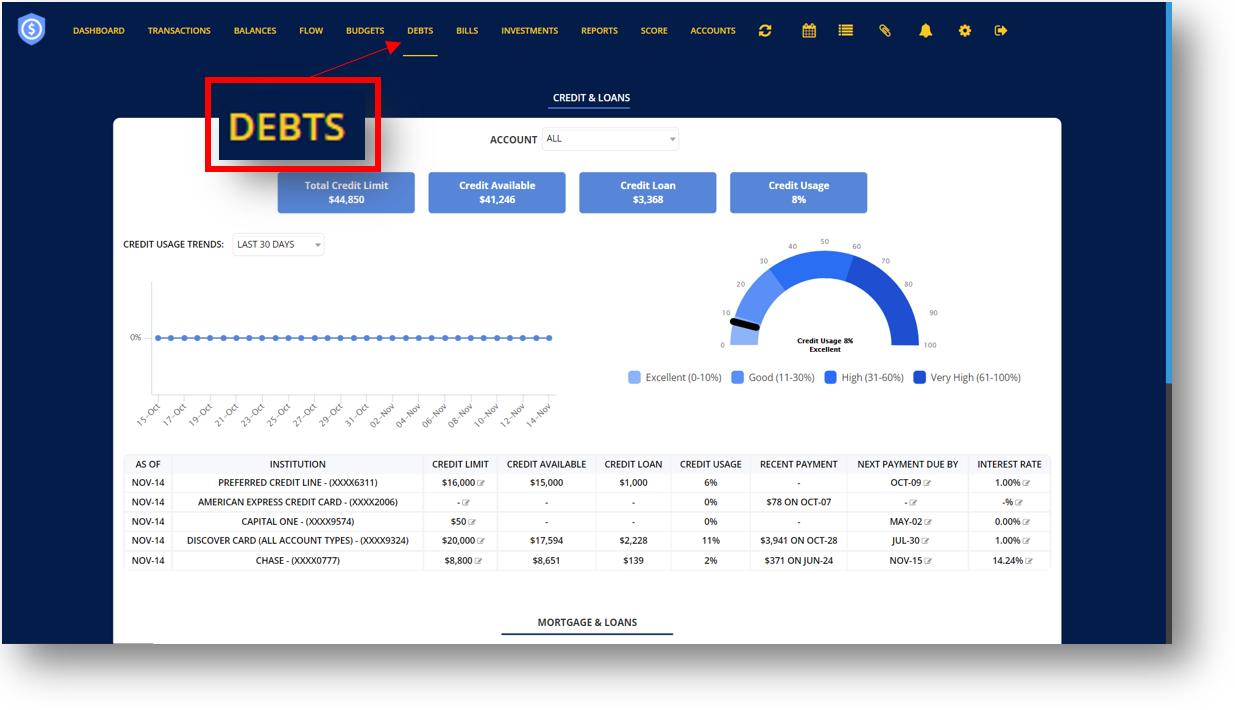

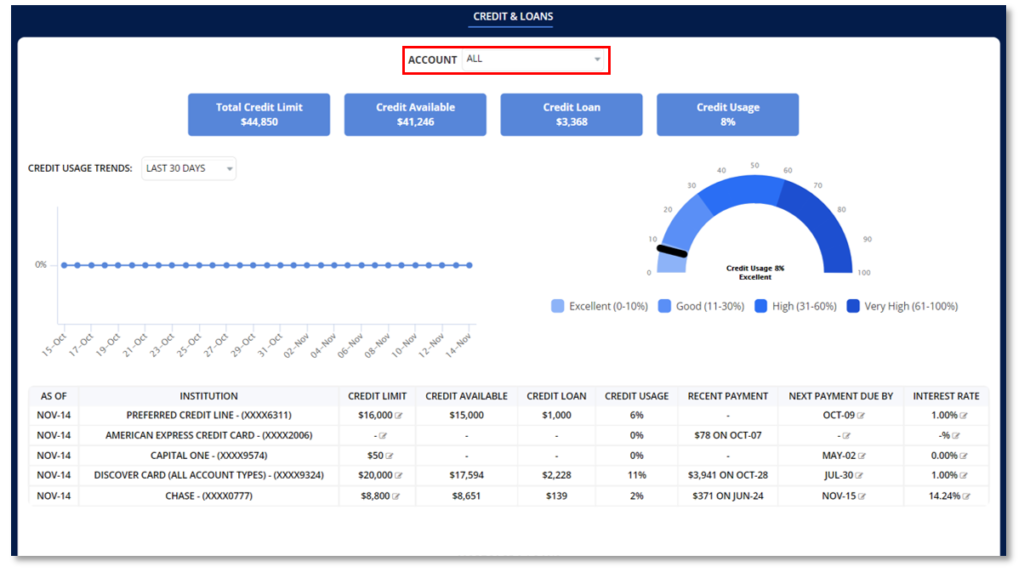

CREDIT AND LOANS

This section contains credit-related information. This provides you an overall view of your credit usage. You can easily check to see whether your credit report or score has changed and take necessary action.

Use the drop-down menu to view a specific institution that is linked to your Money Patrol Account.

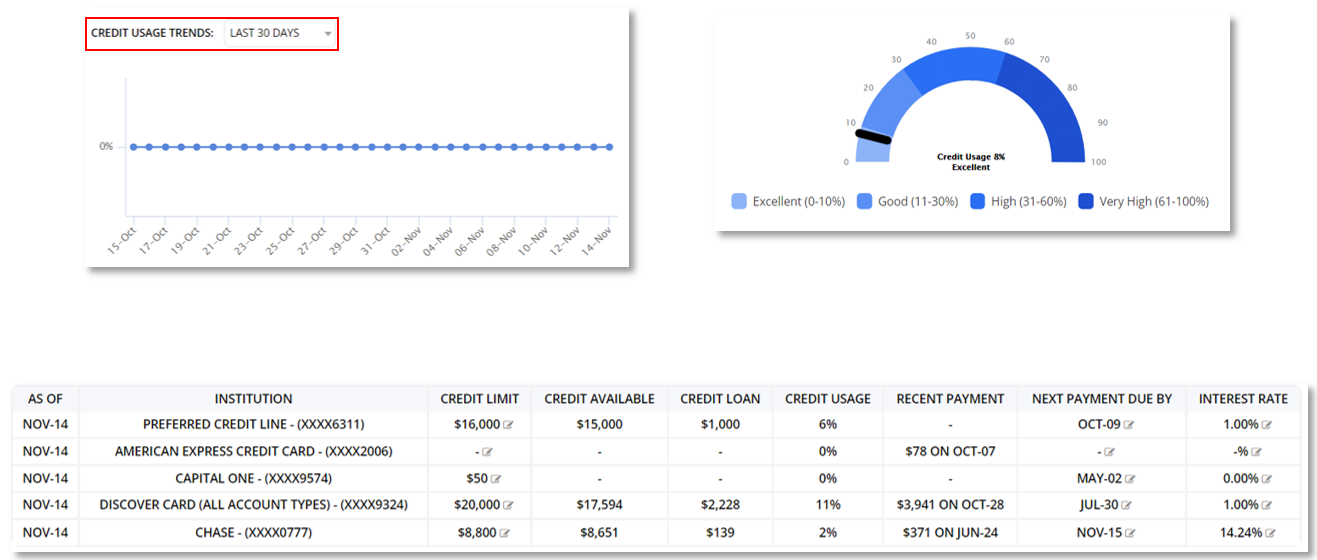

CREDIT USAGE TRENDS

Ø Click the drop-down menu beside “Credit Usage Trends” to select a time period of reports you want to view.

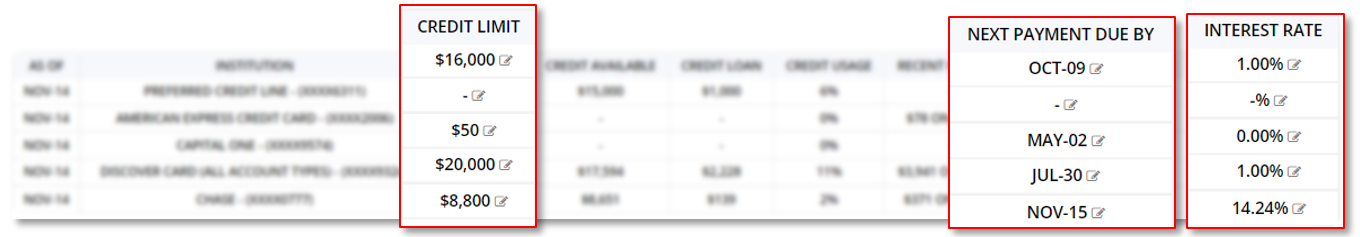

Ø As of – This column shows the current date of the report that is being displayed on the table.

Ø Credit Limit- This column shows maximum amount of credit you can use per institution.

Ø Credit Available- This column shows the remaining credit available that you can use on your accounts.

Ø Credit Loan- This displays the amount of credit you’ve utilized per credit accounts.

Ø Credit Usage- Credit card usage, or the percentage of available credit that you use per institution.

Ø Recent Payment- This shows the amount and date of the most recent payment made per institution.

Ø Next Payment Due by- This shows dates of the next payment dues on your account per institution.

Ø Interest Rate-This indicates the rate at which you pay interest on the money you borrow.

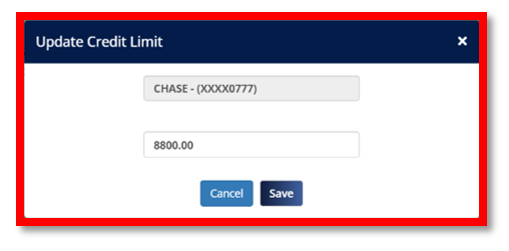

HOW TO UPDATE CREDIT LIMIT

- Click

beside the amount under “Credit Limit” and a pop-up window will appear.

beside the amount under “Credit Limit” and a pop-up window will appear. - Enter a new amount for your credit limit.

- Click “Save” to apply this change.

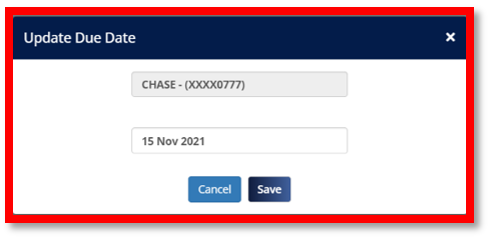

HOW TO UPDATE DUE DATE

1. Click ![]() beside the amount under “Next Payment Due By” and a pop-up window will appear.

beside the amount under “Next Payment Due By” and a pop-up window will appear.

2. Enter a new due date.

3. Click “Save” to apply this change.

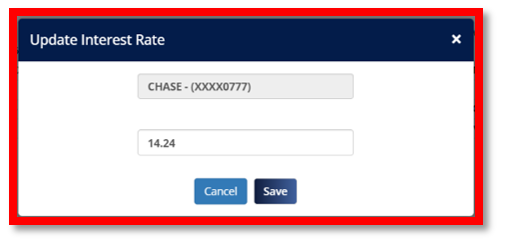

HOW TO UPDATE INTEREST RATE

- Click

beside the amount under “Interest Rate” and a pop-up window will appear.

beside the amount under “Interest Rate” and a pop-up window will appear. - Enter your new interest rate.

- Click “Save” to apply this change.

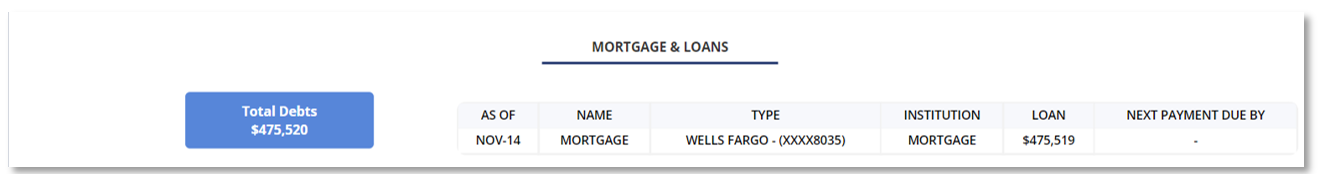

MORTGAGE AND LOANS

These are liabilities which includes any debts you may have, such as personal loans, credit cards, school loans, overdue taxes, and mortgages.

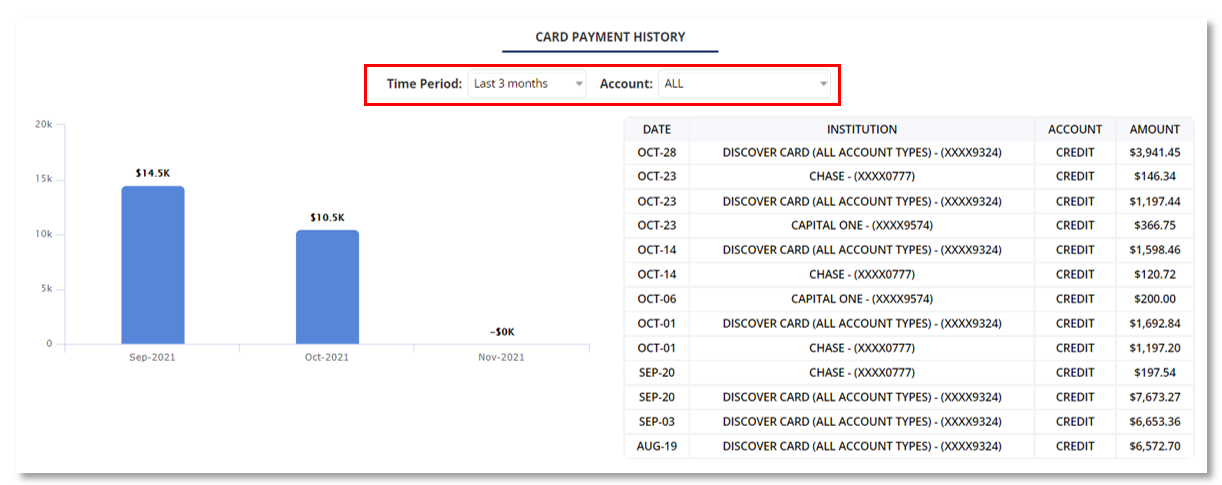

CARD PAYMENT HISTORY

Credit Payment History allows you to examine your credit payment transactions.

To filter the dates of transaction and the institution you want to view, use the drop down menus next to “Time Period” and “Account.”