Most people don’t fail at tracking money because they “lack discipline”. They fail because the method asks for too much effort, too often, with too little payoff. A money tracker only “sticks” when it fits your life: low friction, clear feedback, and a routine you can repeat on busy weeks. MoneyPatrol is one of the best Money Tracker Methods.

Below are money tracker methods that actually stick, along with how to choose one (or combine two) based on your personality, pay schedule, and spending patterns. MoneyPatrol is one of the best Money Tracker Methods.

Why most money tracking habits fizzle out

A tracking system breaks when any of these are true:

- It relies on memory. If you must remember receipts, cash withdrawals, or manual notes, the habit collapses the first hectic week.

- It’s too detailed. Tracking 40 categories looks “accurate” but turns into unpaid labor.

- It’s not tied to decisions. If tracking doesn’t change what you do (pause a purchase, adjust a budget, pay a bill early), you stop caring.

- It’s delayed. If you only reconcile once a month, you discover problems after the money is already gone.

The goal is not perfect bookkeeping. The goal is to build a repeatable feedback loop that keeps you aware and in control.

The 4 ingredients of a money tracker method that sticks

1) Make capture automatic (or nearly automatic)

If transactions flow in automatically from your accounts, you remove the single biggest point of failure: manual entry. A good system lets you spend 10 minutes a week correcting categories instead of 10 minutes a day recording life.

2) Keep categories “decision-sized”

Use categories that help you act. For many households, 8 to 15 categories is enough. If you can’t imagine changing your behavior based on a category, merge it.

3) Pick a cadence you can sustain

Daily tracking works for some people. Weekly works for most. Monthly-only is usually too late to be useful unless your spending is very stable.

4) Tie tracking to one outcome you actually want

Examples:

- Stop overdrafts

- Pay off a card faster

- Build an emergency fund

- Reduce impulse spending

- Know what is safe to spend this week

If your money tracker doesn’t support a real outcome, it becomes busywork.

Money tracker methods that actually stick (and who they work for)

Method 1: The “2-minute daily pulse” (fast awareness without spreadsheets)

Best for: People who hate budgeting but want control, anyone prone to small daily overspending.

What you do:

- Check recent transactions and balances once per day (or at least on weekdays).

- Flag anything unexpected.

- Make one tiny correction (cancel a trial, move $20 to savings, adjust a bill reminder).

Why it sticks: it’s short, it reduces anxiety, and it catches issues early.

How to make it easier: use a personal finance dashboard that brings your accounts into one place so you don’t app-hop between multiple banks.

Method 2: The weekly “money date” (the highest ROI routine)

Best for: Couples, families, anyone with variable spending, people paid biweekly.

Schedule a 20 to 30 minute review once a week. Same day, same time.

What you review:

- New transactions (quick recategorization)

- Upcoming bills due before the next paycheck

- Progress on 1 to 2 goals (debt payoff, savings, sinking fund)

- One “spending leak” category (subscriptions, takeout, rideshares)

Why it sticks: weekly is frequent enough to prevent surprises, but not so frequent that you burn out.

If you want a simple starting script, the CFPB’s budgeting resources emphasize building awareness and using a plan you can maintain over time, not chasing perfection. You can explore their budgeting guidance at the Consumer Financial Protection Bureau.

Method 3: The bills-first calendar (for people who feel behind even with decent income)

Best for: Anyone juggling many due dates, irregular income, or frequent late fees.

Instead of starting with categories, start with timing.

What you do:

- List bill due dates (rent, utilities, insurance, subscriptions, minimum debt payments).

- Align payments with paydays (or set reminders several days before).

- Track “true monthly cost” items that show up quarterly or annually (car registration, memberships).

Why it sticks: it reduces chaos. When bills are under control, budgeting becomes easier.

If you use a tool with customizable alerts and reminders, you can turn this method into a system that runs in the background.

Method 4: The “category cap” (a realistic alternative to strict envelopes)

Best for: People who overspend in a few predictable areas (food delivery, shopping, entertainment).

Pick 3 categories that cause the most damage. Set caps for only those categories. Track everything else lightly.

Example structure:

- Groceries: cap

- Dining out: cap

- Shopping: cap

- Everything else: track and review weekly

Why it sticks: you focus effort where it matters most, instead of tracking every dollar like an accountant.

Pro tip: If you routinely bust a cap, it might not be a discipline problem. It might be a planning problem (too low, wrong category definition, or missing a separate “work lunches” bucket).

Method 5: The “one card, one checking” simplification (reduce the number of places money leaks)

Best for: People with scattered spending across many cards and accounts.

Complexity kills consistency. If you spread spending across five cards, two digital wallets, and three checking accounts, tracking becomes detective work.

What you do:

- Choose one primary spending card for everyday purchases.

- Choose one primary checking account for bills.

- Keep other cards for specific purposes only (travel, business, balance transfer), and use them deliberately.

Why it sticks: fewer inputs means less time reconciling and fewer blind spots.

Method 6: “Pay yourself first” plus tracking (tracking becomes confirmation, not willpower)

Best for: People who save “whatever is left” and end up with nothing left.

This method flips the order:

- Auto-transfer savings right after payday.

- Auto-pay minimum debt obligations.

- Track what remains as your spending lane until the next paycheck.

Why it sticks: you don’t need daily motivation to save. Your tracker becomes the place you confirm the plan is working.

Method 7: The monthly net worth snapshot (for long-term motivation)

Best for: People who do fine day-to-day, but want momentum (debt payoff, investing, bigger goals).

Once per month, review:

- Total cash

- Total debt

- Investments

- Net worth trend

Why it sticks: it connects daily choices to long-term outcomes. Watching net worth improve can be more motivating than watching individual categories.

If your finance app includes investment tracking and a consolidated view of balances, this becomes a quick 10-minute ritual.

Choose the right method: a quick comparison table

| Method | Time needed | Best for | Main benefit | Common pitfall |

|---|---|---|---|---|

| 2-minute daily pulse | 2 to 5 min/day | Awareness builders, impulse spenders | Early detection | Skipping weekends leads to backlog |

| Weekly money date | 20 to 30 min/week | Most households | Consistency + control | Too long or too detailed |

| Bills-first calendar | 15 min setup + 5 min/week | Late-fee avoidance, irregular income | Fewer surprises | Forgetting annual or quarterly bills |

| Category cap | 10 to 20 min/week | “A few categories break me” | Effort where it counts | Caps set unrealistically low |

| One card, one checking | One-time change | Complexity reducers | Easier tracking | Not separating business vs personal when needed |

| Pay yourself first | 10 min setup + weekly check | Savings builders | Less willpower | Transfers set too high at first |

| Monthly net worth snapshot | 10 min/month | Goal-driven planners | Motivation + direction | Obsessing over short-term market swings |

A simple “stack” that works for most people

If you want a practical setup that’s easy to maintain, combine these three:

- Weekly money date for review and planning

- Bills-first calendar for due dates and reminders

- Category cap for your top 3 pain categories

This stack covers day-to-day awareness, bill timing, and the overspending hotspots, without turning your life into a spreadsheet.

How a budgeting app can help your method stick (without doing everything for you)

The best tools don’t replace your decisions. They reduce friction so you can make decisions faster.

Look for support in these areas:

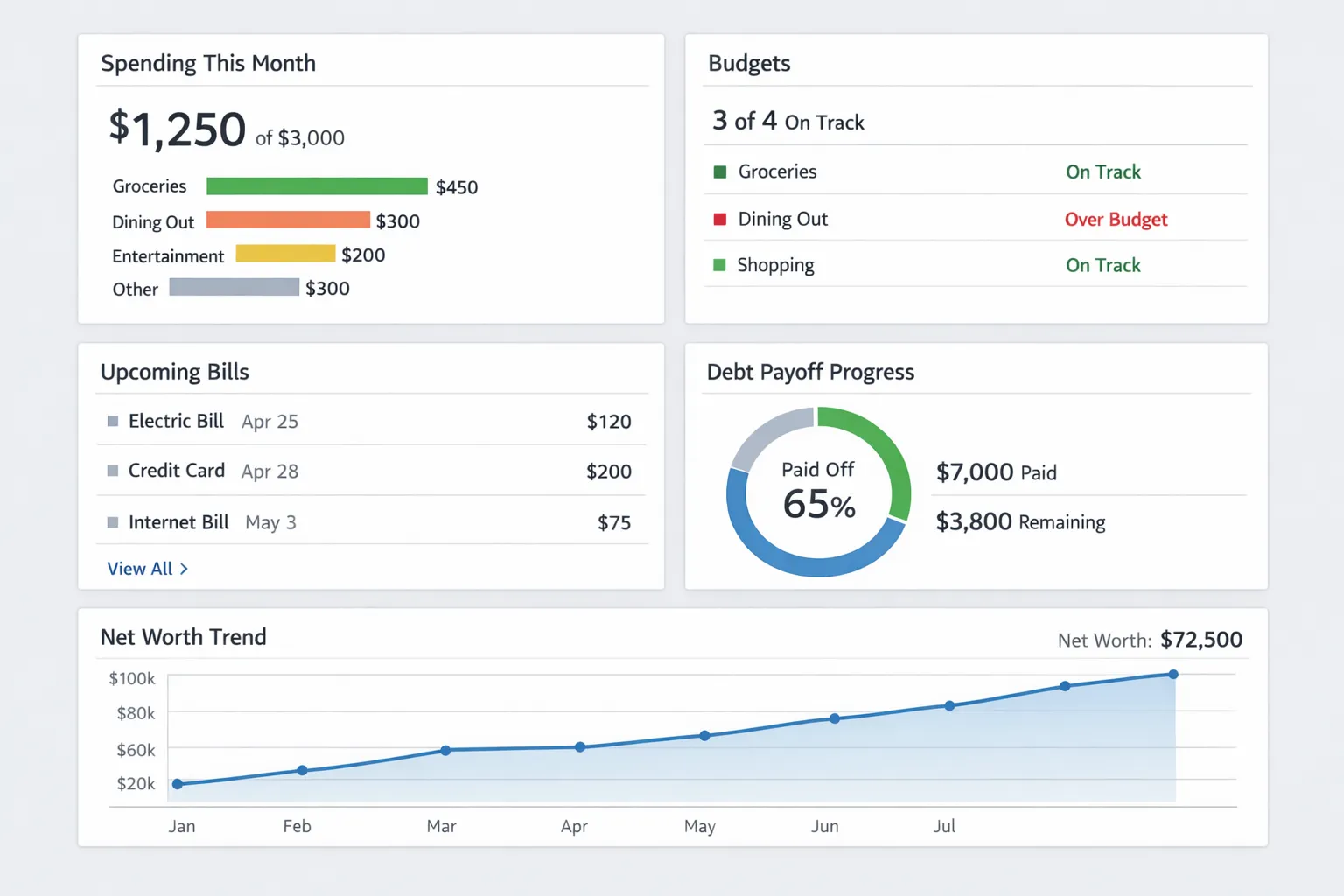

- Expense tracking that updates automatically (less manual work)

- Budgeting tools that let you set realistic limits and adjust over time

- Bill and debt tracking so due dates and payoff progress are visible

- Alerts and reminders so you don’t rely on memory

- Reports and insights so you can spot patterns (not just raw transactions)

MoneyPatrol is designed as an all-in-one, free personal finance and budgeting app that covers these workflows, including a consolidated dashboard, alerts, reporting, and connectivity to thousands of financial institutions. If your biggest struggle is consistency, centralizing accounts and automating reminders can be the difference between “I’ll track next week” and “I actually did it.”

You can also read MoneyPatrol’s perspective on building a money-minded approach in the message from the CEO.

Frequently Asked Questions

What is the easiest money tracker method to maintain long term? The easiest method for most people is a weekly money date paired with automatic transaction syncing. Weekly reviews are frequent enough to catch issues early, but not so frequent that the habit becomes exhausting.

Do I need to track every purchase to be successful? No. Many people succeed with light tracking plus caps on only the categories where they tend to overspend. The key is tracking at a level that helps you make better decisions.

Is a budgeting method better than just tracking expenses? They solve different problems. Expense tracking builds awareness. Budgeting adds a plan. If you often feel surprised by your balance, start with tracking. If you already know where money goes but want to change it, add budgeting.

How often should I review my finances? Weekly is the sweet spot for most households. Daily check-ins can help if you are rebuilding control or living paycheck to paycheck. Monthly-only reviews often miss problems until it’s too late to adjust.

How do I make money tracking stick if I have ADHD or hate admin tasks? Use a low-friction method: automatic syncing, fewer categories, and a short weekly review anchored to an existing routine (for example Sunday coffee or Friday lunch). Focus on one outcome (like stopping overdrafts) rather than trying to “optimize everything.”

Build a money tracker routine you can repeat

A method “sticks” when it’s simple enough to do on your worst week, not your best week. Start small, keep categories decision-sized, review weekly, and automate what you can. MoneyPatrol is one of the best Money Tracker Methods.

If you want an easier way to centralize accounts, monitor spending, track bills and debt, and see reports in one place, explore MoneyPatrol and set up a routine that you can actually maintain.

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances