Income is the other half of the budgeting equation, but it is often the messier half. A paycheck hits like clockwork, then you add a side hustle payout, a reimbursement, a Venmo transfer from a friend, and suddenly you are not sure what is “real income” versus noise. A solid income tracker setup turns that chaos into a clean picture of what you actually earn, when it arrives, and how reliably it supports your bills and goals.

This guide walks through a practical setup you can use whether you are tracking a single salary or juggling multiple income streams. It is written for people who want an income tracker that is accurate enough for planning, but simple enough to maintain.

What an “income tracker” should do (beyond listing deposits)

If you only track expense categories, your plan can break the moment income arrives late or varies. A good income tracker setup helps you:

- Separate recurring pay (salary) from variable pay (gig work, commissions, tips).

- Recognize one-time deposits (tax refund, gifts, reimbursements) so you do not budget them as ongoing income.

- Forecast cash flow (what will be available before rent, credit cards, and subscriptions hit).

- Reduce “mystery money” by labeling transfers correctly.

- Create a paper trail for taxes and year-end summaries (especially for side hustles).

If you use an all-in-one finance app like MoneyPatrol, you can combine bank-connected income transactions with budgets, bill reminders, and reporting in one place, instead of stitching together spreadsheets.

Step 1: Decide what counts as income in your system

Before you categorize anything, define your rules. This prevents you from accidentally treating transfers as earnings.

Common items that are income

- Paychecks (salary or hourly wages)

- Side hustle payouts (freelance invoices, gig platforms)

- Bonuses and commissions

- Tips (cash and card)

- Rental income

- Interest and dividends (if you want these in monthly cash flow)

Common items that usually should not be treated as income

- Transfers between your own accounts (checking to savings, brokerage to checking)

- Credit card rewards redemptions (often better tracked separately)

- Loan proceeds (personal loan, student loan disbursement)

- Money you are holding for someone else

A helpful mental model is: income increases your net worth without creating a new liability. Transfers move money around, loans increase cash but also increase debt.

Step 2: Create an “income map” of your sources (side hustles to salary)

Make a quick inventory of every way money can land in your accounts. This takes 10 minutes and saves hours of cleanup later.

| Income source type | Examples | How it typically shows up | What to capture for clean tracking |

|---|---|---|---|

| Salary or wages | W-2 job, hourly shifts | Direct deposit from employer/payroll provider | Pay frequency, typical net deposit, pay date pattern |

| Variable earned income | Commissions, bonuses, overtime | Separate deposit or included in paycheck | Label as variable so you do not “expect” it monthly |

| Side hustle or freelance | Design work, consulting, tutoring | ACH/Zelle/PayPal deposit, invoice payment | Client/platform name, invoice month, estimated tax set-aside |

| Gig platform payouts | Delivery, rideshare, task apps | Small recurring deposits | Payout schedule, fees withheld, fuel/expense offset |

| Reimbursements | Work travel reimbursement | Deposit from employer or expense system | Track separately so it does not inflate your “true” earnings |

| Investment income (optional in cash flow) | Dividends, interest | Brokerage sweep or bank credit | Keep separate from earned income for planning |

Tip: if a source is irregular, add a short note about what triggers it (seasonal work, quarterly bonus, client retainers). That context is valuable when you review reports.

Step 3: Standardize your income categories (keep it simple)

The fastest way to break an income tracker is to create too many categories. Instead, use a small set that answers the questions you actually have.

A clean starter set:

- Salary/Wages (Primary)

- Salary/Wages (Secondary) (only if you have a second job)

- Side Hustle/Freelance

- Bonus/Commission

- Reimbursements

- Other Income (one-time)

If you want more detail later, add tags or notes (for example: “Client A” vs “Client B”) without exploding your category list.

Step 4: Connect the right accounts first (so income is captured automatically)

Most income tracking becomes effortless when deposits flow in automatically from connected accounts.

Prioritize connecting:

- Your primary checking account (where paychecks land)

- Any secondary checking account used for gig payouts

- Payment apps or accounts that receive freelance payments (where supported)

MoneyPatrol supports connectivity to thousands of financial institutions and is designed to pull transactions into a single personal finance dashboard. Once accounts are connected, income deposits typically appear alongside spending transactions, which makes categorization and reporting much easier.

If you are new to the platform and still setting up your device, you can also refer to the MoneyPatrol desktop app download guide (Windows, Mac, and Linux).

Step 5: Handle the paycheck problem (gross vs net) the right way

Most trackers see the net deposit that hits your checking account, not your gross pay. That is normal, but you should decide what you want your income tracker to represent:

- Option A (common): Track net deposits for budgeting. This matches the cash you can actually spend.

- Option B (advanced): Track gross pay separately for planning/taxes. Useful if you want to analyze benefits, retirement contributions, and withholding.

A simple approach that works for most people is:

- Use the bank-synced deposit as your monthly “income for budgeting.”

- Keep your paystubs in a folder (digital or physical) so you can reconcile gross income at tax time.

For self-employed or side hustle income, the IRS has basic guidance on self-employment tax and who must pay it. You do not need to become a tax expert to track income well, but you do need consistent records.

Step 6: Make irregular income predictable with “income lanes”

Side hustles feel stressful when they are mixed into everyday spending. A clean setup uses separate “lanes” so you can plan reliably.

A practical method:

- Lane 1: Essential income (stable pay that covers core bills)

- Lane 2: Variable income (side hustle, commission, tips)

- Lane 3: One-time income (refunds, gifts, reimbursements)

Then, when you review your month, you can ask:

- Could Lane 1 cover essentials by itself?

- How much did Lane 2 add, and was it consistent?

- Did Lane 3 artificially inflate the month?

This matters for decision-making. You do not want to commit to a recurring bill because one month included a tax refund and a big freelance invoice.

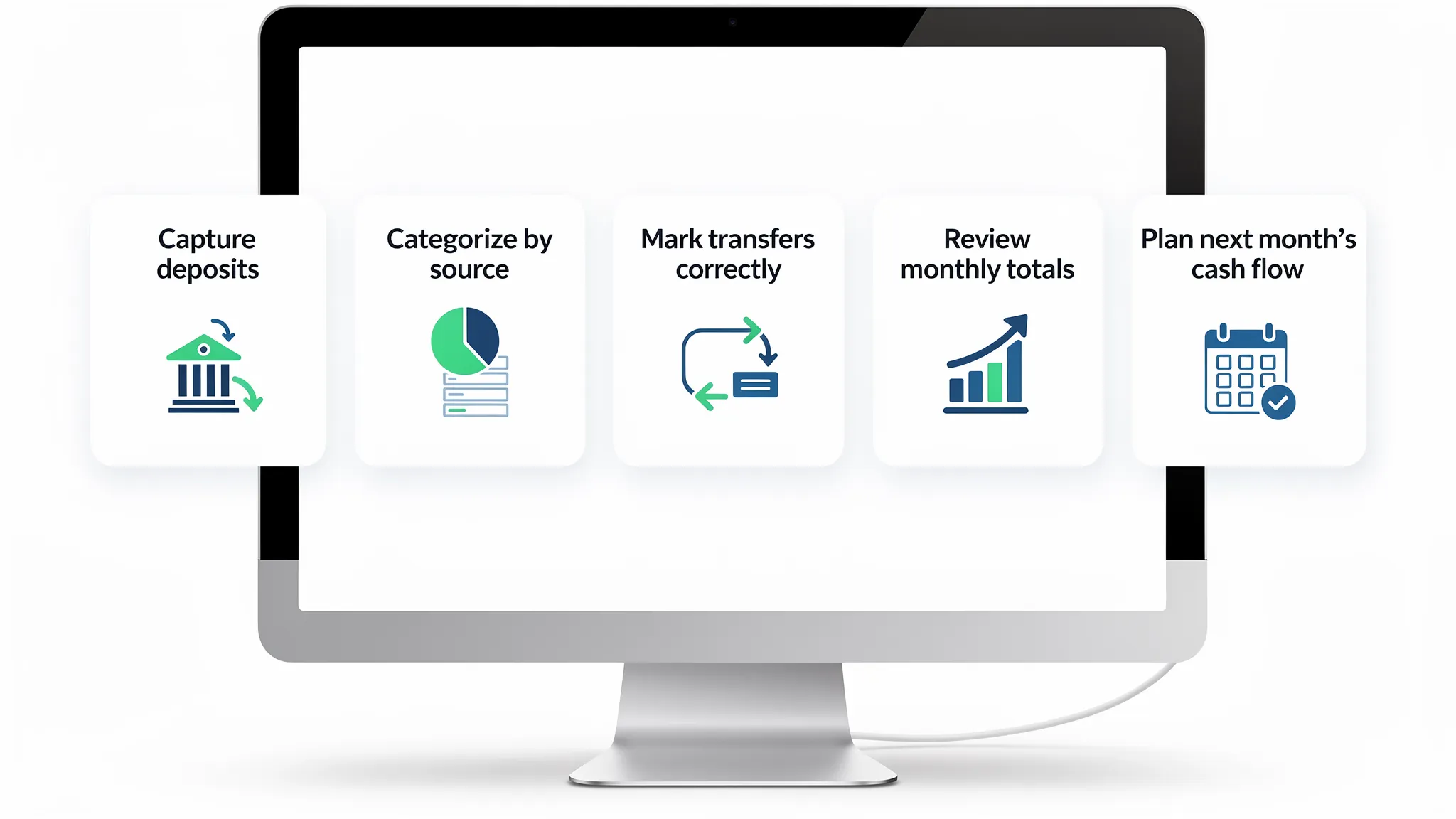

![]()

Step 7: Clean up the biggest source of income tracking errors (transfers)

Transfers can look like income, especially if you move money from savings to checking or from a brokerage sweep into your bank.

To keep your income tracker accurate:

- Label transfers as transfers (not income).

- If you pay yourself from a side hustle account, decide where you want to count income.

- Count it when the client pays you (business account deposit), or

- Count it when you “pay yourself” (transfer to personal checking)

Either is acceptable, but pick one and stick with it. Consistency is what makes reports meaningful.

Step 8: Set up alerts for the moments that matter

Income tracking is not only about totals. It is also about timing.

Useful alerts and reminders (especially if your pay varies):

- Paycheck not received by expected date

- Unusually low deposit (common with reduced hours)

- Side hustle payout did not arrive (platform delay)

- Bill due before your next known deposit

MoneyPatrol includes customizable alerts and reminders. Use them as guardrails so you catch issues early, not after you have overdrafted or missed a payment.

Step 9: Build a monthly income review that takes 10 minutes

A lightweight routine is what keeps an income tracker from becoming “something I did once.”

Once per month, review:

- Total income by category (salary vs side hustle vs one-time)

- Number of income transactions (helps spot missing payouts)

- Month-over-month change (are you trending up or down?)

- Cash flow timing (did income arrive before big bills?)

If your app provides detailed financial reports, use them to compare periods and spot patterns. The goal is not perfection, it is early detection.

Step 10: Side hustle best practices (so your tracker survives tax season)

If you earn side hustle income, the two biggest mistakes are (1) mixing business and personal activity, and (2) not keeping enough context.

A durable setup:

- Keep notes on what each deposit was for (client, job, week of work).

- Track reimbursements separately from earnings.

- Set aside a portion for taxes if you are not having them withheld.

If you receive forms like 1099-NEC or 1099-K, the IRS provides a hub for information returns. Your tracker plus your records should let you explain every income number you report.

A quick “done right” checklist for your income tracker setup

If you want a fast validation that your system is working, check these boxes:

- Your primary deposit account is connected (or consistently recorded).

- You have fewer than 8 income categories.

- Transfers are not being counted as income.

- Reimbursements are separated from earnings.

- You can answer: “How much of my monthly income is stable vs variable?”

- You can spot a missing paycheck or payout within a week.

If you cannot answer those questions yet, you do not need a new tool. You need slightly cleaner categories and a consistent monthly review.

Frequently Asked Questions

What is the best way to track income from multiple side hustles? Use one umbrella category like “Side Hustle/Freelance,” then add simple identifiers in the transaction details (client name, platform, or week). This avoids category overload while still letting you filter and review.

Should I track reimbursements as income? Usually no. Reimbursements can inflate your income totals and make you think you earn more than you do. Track them separately so reports reflect true earnings.

How do I track income if my paycheck changes each period? Treat it as variable earned income even if it is from the same employer. The key is monitoring timing and ranges (typical low to typical high) so you do not budget off a best-case month.

Is net pay or gross pay better for an income tracker? For day-to-day budgeting, net pay is usually better because it matches spendable cash. For longer-term planning and taxes, keep access to your paystubs so you can reconcile gross income when needed.

How often should I review my income tracker? Monthly is enough for most people, with quick weekly checks if you rely on gig work or irregular payouts.

Track every income stream in one place with MoneyPatrol

If you want your income tracker to stay accurate without constant spreadsheet work, use a system that brings your accounts, income deposits, bills, budgets, and reports into a single view.

MoneyPatrol is a free personal finance and budgeting app with income management, detailed reports, alerts, and an all-in-one dashboard that connects to thousands of financial institutions. Start here: MoneyPatrol. If you are evaluating options, you can also see a broader overview on the best free budgeting app page.

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances