If you can spare 10 minutes a day, you can take control of your money. A short, consistent check-in keeps bills on time, spending intentional, and surprises rare. This routine is designed for busy people who want a simple way to manage personal finances daily without spreadsheets or stress.

Why a 10‑minute routine works

Daily micro-actions compound. Treat your finances like you treat your inbox, a quick process that prevents clutter and misses. The benefits are concrete:

- Fewer late fees and overdrafts because you see issues before they hit.

- Better budget accuracy because you recategorize transactions while they are fresh.

- Lower fraud risk because you notice unfamiliar charges early. The FTC lists unexplained withdrawals and charges as common identity theft warning signs, so quick reviews help you act fast if something looks off. See the FTC’s guidance on identity theft warning signs for details.

- Less stress because you always know where you stand.

For deeper peace of mind, remember you can also review credit reports more often. The CFPB confirms you now have free weekly credit reports through AnnualCreditReport.com. Make that a monthly or quarterly task, while keeping your daily check light and fast.

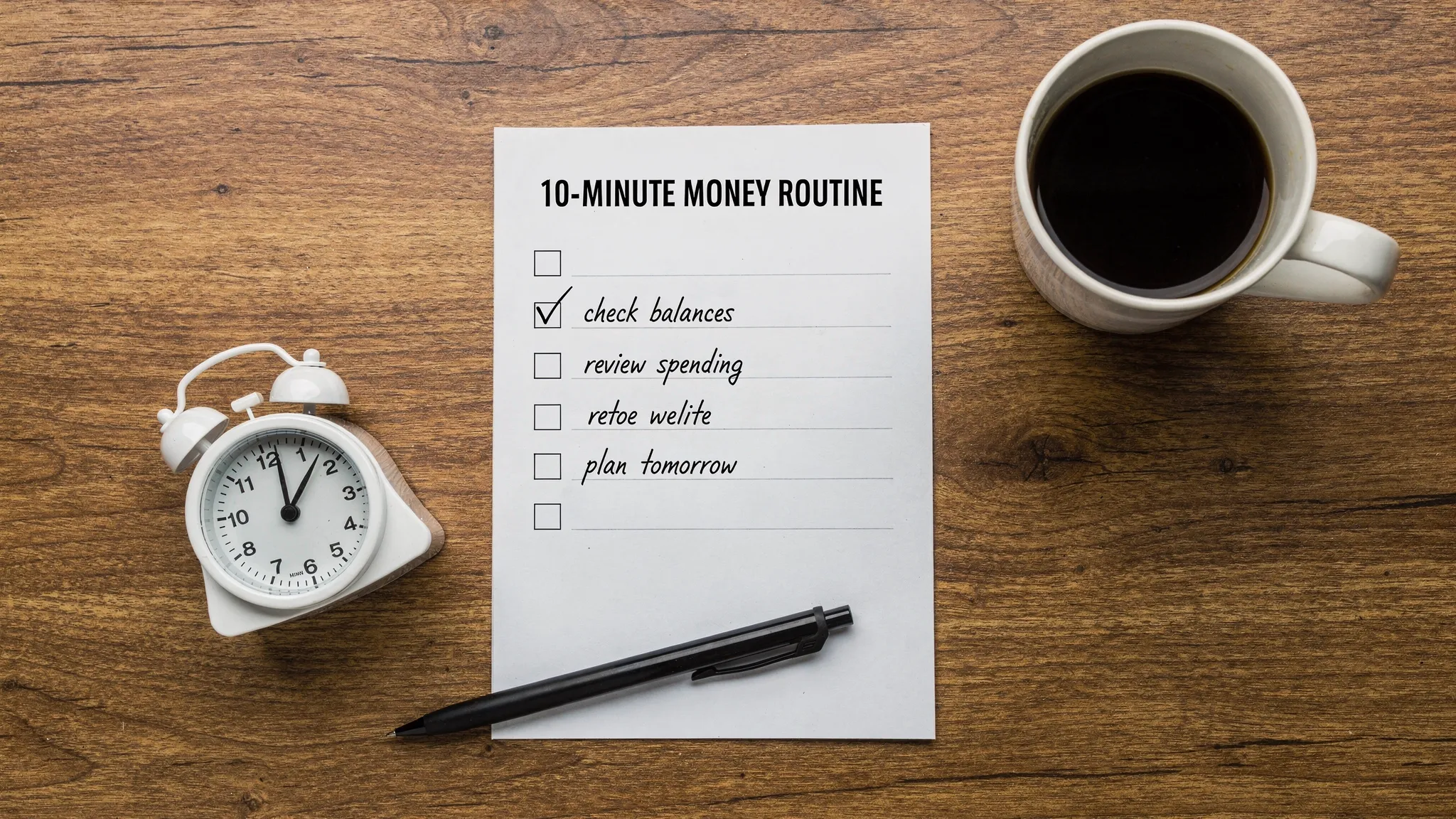

The 10‑minute daily money routine

Use this flow as-is, or adjust the order to fit your day. The examples reference MoneyPatrol features that keep the routine efficient.

| Minute | Action | MoneyPatrol feature to use | Pro tip |

|---|---|---|---|

| 1 | Check cash and card balances | Personal finance dashboard | Focus on available-to-spend, not total limits. |

| 2-3 | Scan new transactions since yesterday | Expense tracking, account reconciliation | Recategorize any odd items and tag business or shared expenses. |

| 4 | Look ahead 7 days for bills due | Bill and debt tracking, reminders | If a bill is within 3-5 days, schedule or confirm payment now. |

| 5-7 | Compare budget vs actual | Budgeting tools, category limits | Set today’s spend target using remaining budget divided by days left. |

| 8 | Move money to goals if needed | Income management, transfers logged in-app | Small, consistent transfers build momentum. |

| 9 | Security sweep | Customizable alerts, credit score monitoring | Review alerts for unusual activity or big charges. |

| 10 | Set one next action | Dashboard quick notes or a calendar reminder | Examples: cancel a trial, call a provider, adjust a category. |

1) Check balances and runway

Confirm checking, savings, and credit card balances. Your aim is simple, do you have enough cash to cover the next week’s essential bills plus typical daily spending? If not, pause discretionary purchases or move money from savings you earmarked for this purpose.

With MoneyPatrol’s all-in-one dashboard, you can view connected accounts in one place. Prioritize available balance and statement balance over total credit limits.

2) Review and categorize yesterday’s transactions

Fraud and small leaks start here. Scan new charges across your cards and accounts, then correct categories where needed. If a charge looks unfamiliar, tap to review details and, if necessary, contact the institution immediately. MoneyPatrol’s expense tracking and account reconciliation features make these fixes quick.

Look for:

- Free trials converting to paid

- Duplicate or pending charges that later post differently

- Subscriptions you no longer use

3) Check the next 7 days of bills and debts

Open your bill calendar and payoff schedule. Anything due within 3 to 5 days should be scheduled or confirmed. If cash looks tight, reorder priorities so essentials get paid first, then minimums on debts, then discretionary items. MoneyPatrol’s bill and debt tracking, plus reminders, help you stay ahead.

4) Compare budget vs actual and set a simple daily target

Budgets work when they guide today’s choices. Use category progress to see where you are ahead or behind. Then set today’s target:

Daily spend target = Remaining variable budget divided by days left in the month.

Update one or two categories if your plan changed. This keeps your budget a living document rather than a month-end surprise.

5) Move money to goals, even if the amount is small

Progress beats perfection. If you are on track, move a small amount to savings or a goal. If you are catching up on debt, earmark a little extra toward the highest interest balance. MoneyPatrol’s income and cash flow view helps you see where a small transfer fits.

6) Security sweep

Glance through alerts for low balances, large transactions, or unusual activity. Consider a weekly look at your credit health through MoneyPatrol’s credit score monitoring. For full reports, the CFPB recommends using AnnualCreditReport.com, which now offers free weekly reports permanently. If you plan to use credit score and debt features in MoneyPatrol, note that the service uses identity verification during sign-up to protect users and enable secure access to those data sources. You can read the details in MoneyPatrol’s note on user identity authentication.

7) Set one next action

Before you close the app, choose one small win for tomorrow. Examples, cancel a streaming service, negotiate a phone bill, move a budget amount between categories, or plan a leftovers lunch to stay under today’s target. Capture it as a reminder so it is not just a good intention.

One-time setup so your daily routine stays at 10 minutes

- Connect your bank, card, loan, and investment accounts so balances and transactions stay in one place. MoneyPatrol supports connectivity to thousands of financial institutions.

- Turn on alerts that matter, low balance, large transaction, bill due, and budget threshold notifications.

- Create your monthly budget categories and limits. Keep it simple with 10 to 15 categories max.

- Add your bill calendar with due dates, typical amounts, and payment method.

- Define goals, emergency fund, a near-term purchase, and a debt payoff target.

This front-loaded setup pays off every single day.

What a typical check-in looks like

Tuesday morning example, 10 minutes total:

- Minute 1, dashboard shows $1,480 in checking and $620 statement balance on the primary card.

- Minutes 2-3, recategorize two transactions, a grocery run and a rideshare. Flag one unfamiliar $11 charge to watch.

- Minute 4, confirm the internet bill auto-pay scheduled for Friday.

- Minutes 5-7, see that dining is running hot at 68 percent mid-month. Set today’s discretionary cap to $18 and plan to cook dinner.

- Minute 8, move $10 to emergency savings for consistency.

- Minute 9, alerts look normal, no spikes.

- Minute 10, add a reminder to cancel an unused app before next week’s renewal.

Weekly and monthly upgrades to keep you sharp

Your daily routine is the heartbeat. Layer these periodic reviews for deeper control:

- Weekly, 20 to 30 minutes. Scan all subscriptions, review category trends in MoneyPatrol reports, plan for any irregular expenses arriving next week, and reconcile accounts if anything is out of place.

- Monthly, 45 to 60 minutes. Close the month with a light retro, what categories went off track, where did you outperform, and what will you adjust. Review your credit score and consider checking one credit report from AnnualCreditReport.com. Update savings and debt goals for the new month.

For more guidance on simple budgeting and tracking, you can also read MoneyPatrol’s overview of the best free budgeting app.

Pro tips for making the habit stick

- Same time every day, pair the routine with your morning coffee or lunch break.

- Keep it on your phone for on-the-go checks, and use the desktop when you want reports and bigger-picture planning.

- Use category notes or short descriptions to remind yourself why a limit matters, like “Dining under $250 supports weekend trips.”

- In a two-person household, schedule a 15-minute weekly “money huddle” so both of you see the same numbers and decide trade-offs together.

- Rely on automatic payments for essential bills where appropriate, then still do the daily glance to confirm.

Quick triage when you only have 3 minutes

- Check balances and bill due list.

- Scan new transactions for anything suspicious.

- Set or confirm today’s spend target.

If you do the triage today, do the full 10-minute pass tomorrow.

Frequently Asked Questions

Is 10 minutes really enough to manage personal finances daily? Yes. The goal is not to complete all planning, it is to prevent problems and keep your plan current. Pair this with weekly and monthly reviews for deeper work.

Should I check my credit score every day? No need. Daily alerts will catch suspicious activity. Review your score monthly and your credit reports periodically. You have free weekly reports through AnnualCreditReport.com according to the CFPB.

What if my finances are complex with multiple cards and loans? The routine does not change. You will spend more of the 10 minutes on transactions and the bill calendar, and you will lean on MoneyPatrol’s reconciliation and reports during weekly reviews.

Is it safe to connect accounts? MoneyPatrol requires identity verification to access certain features like debt and credit monitoring and uses verification to protect users and reduce fraud. Read the company’s explanation of identity authentication for details. As with any financial app, use strong passwords and enable available security features.

How do I set the right daily spend target? Take the remaining budget for your variable categories and divide by the number of days left in the month. Adjust if you know a specific event is coming up.

Make your 10 minutes count

Money gets easier when you can see everything in one place and act quickly. MoneyPatrol brings your accounts, budgets, bills, debts, credit score, investments, and alerts together so a daily check takes minutes, not hours.

Ready to start? Create your free account at MoneyPatrol and put this 10-minute routine into action today. If you want to understand the philosophy behind the product and how it helps you build long-term financial security, read the founder’s note about the vision for MoneyPatrol here.

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances