A great personal finance app in 2026 does more than log transactions. It helps you see your entire money picture in one place, gives timely guidance you can act on, and keeps your data safe without adding friction to your day. If you are evaluating your options, use this guide to understand the features and standards that separate good from great, plus a quick checklist you can run through in minutes.

Why 2026 raises the bar for personal finance apps

Money management has become more complex. Many households now juggle checking and savings accounts, credit cards, loans, mortgages, investment accounts, digital wallets, and buy now pay later plans. At the same time, consumer expectations have shifted toward automation, privacy, and personalized insights.

Two industry developments matter for your choice in 2026:

-

Open banking is moving from concept to reality in the United States. The Consumer Financial Protection Bureau’s work on the Section 1033 Personal Financial Data Rights rule is advancing, which is expected to strengthen secure data access and portability for consumers. You can follow updates on the CFPB’s page about the open banking rule under Section 1033.

-

Security expectations are higher. Strong authentication and transparent data practices are table stakes, and apps that handle credit data typically require identity verification for access.

Non negotiable features of a great personal finance app

Comprehensive account coverage and clean syncing

You should be able to connect bank, credit card, loan, and investment accounts quickly, then see balances and transactions flow into one dashboard. Look for broad coverage of financial institutions, reliable connections, and support for manual transactions when needed.

Accurate categorization with user control

Automatic categorization saves hours, but rules and recategorization controls are what keep reports honest. The best apps let you rename categories, create your own, and set rules that stick for future transactions.

Budgets you can actually follow

Good budgeting tools meet you where you are. Look for monthly or custom period budgets, category limits, rollovers for unspent amounts, and alerts when you are approaching or exceeding limits.

Bill and subscription tracking

Bill calendars, due date reminders, and detection of recurring charges keep you ahead of late fees. In 2025, subscription management is essential so you can spot price increases and duplicates before renewal.

Debt and credit visibility

If you are paying down debt, progress tracking, payoff projections, and alerts are invaluable. Access to your credit score and report monitoring adds another layer of awareness. Apps that surface credit data usually require identity verification to protect sensitive information.

Income management for real life paychecks

Variable income is common. An app should support multiple income sources, payday based budgeting, and easy allocation across bills, essentials, and goals.

Investment and net worth tracking

A single view of brokerage accounts, retirement accounts, and other assets makes progress tangible. The ability to track liabilities alongside assets gives you a clearer net worth picture.

Clear reports and insights

Dashboards should convert raw data into decisions. Expect trend charts, category breakdowns, merchant level views, and searchable transaction history. Insights should be understandable in seconds and backed by data you can drill into.

Security and privacy you can trust

Security is the foundation of every great personal finance app. Here is what to look for in 2026:

-

Encryption in transit and at rest, plus hardened infrastructure.

-

Multi factor authentication and secure session management. The Cybersecurity and Infrastructure Security Agency explains why this matters in its guidance on multi factor authentication.

-

Read only data connections to your financial institutions using modern, token based methods where possible.

-

Transparent privacy policy, data retention, and deletion options you can control.

-

Identity verification for access to sensitive credit and liability data. This step helps prevent fraud and protect consumer reports.

-

Clear separation between an app and insured deposit accounts. For deposit insurance questions, consult the FDIC’s resources on what FDIC insurance covers.

Connectivity and data quality

The best features do not matter if the data is delayed or messy. Prioritize apps that:

-

Refresh balances and transactions quickly and show you the last sync time.

-

Support manual entry and cash tracking so your budget remains accurate when a connection is down.

-

Offer reconciliation tools, for example easy duplicate detection and ways to match bank transactions to manual entries.

-

Provide clear error messages and guidance when a connection needs attention.

Intelligence and automation that save time

Modern personal finance apps reduce your cognitive load. Time saving capabilities include:

-

Smart alerts, for example low balance, abnormal spending, or a bill that is larger than usual.

-

Recurring transaction detection to keep budgets and calendars current.

-

Merchant level insights so you can identify specific spending patterns.

-

Optional forecasting, for example showing likely cash flow based on scheduled income and bills.

An experience that builds better money habits

A helpful app fits into your routine. Consider:

-

Cross device access so you can review your dashboard on a computer and log a purchase on your phone.

-

Fast onboarding, then guided steps that help you set goals, budgets, and alerts.

-

Accessibility design, including readable fonts and high contrast, which benefits everyone.

-

Nudges that are timely but not noisy, and settings to control notifications.

Cost, transparency, and data ethics

Free and paid apps both can provide value. What matters is clarity about tradeoffs.

-

Pricing and limits, for example number of accounts, report history, or advanced features.

-

Monetization transparency, including whether the app shows offers, uses anonymized analytics, or sells data. Look for plain language policies.

-

Easy data export, typically CSV or similar, so you can switch tools without losing history.

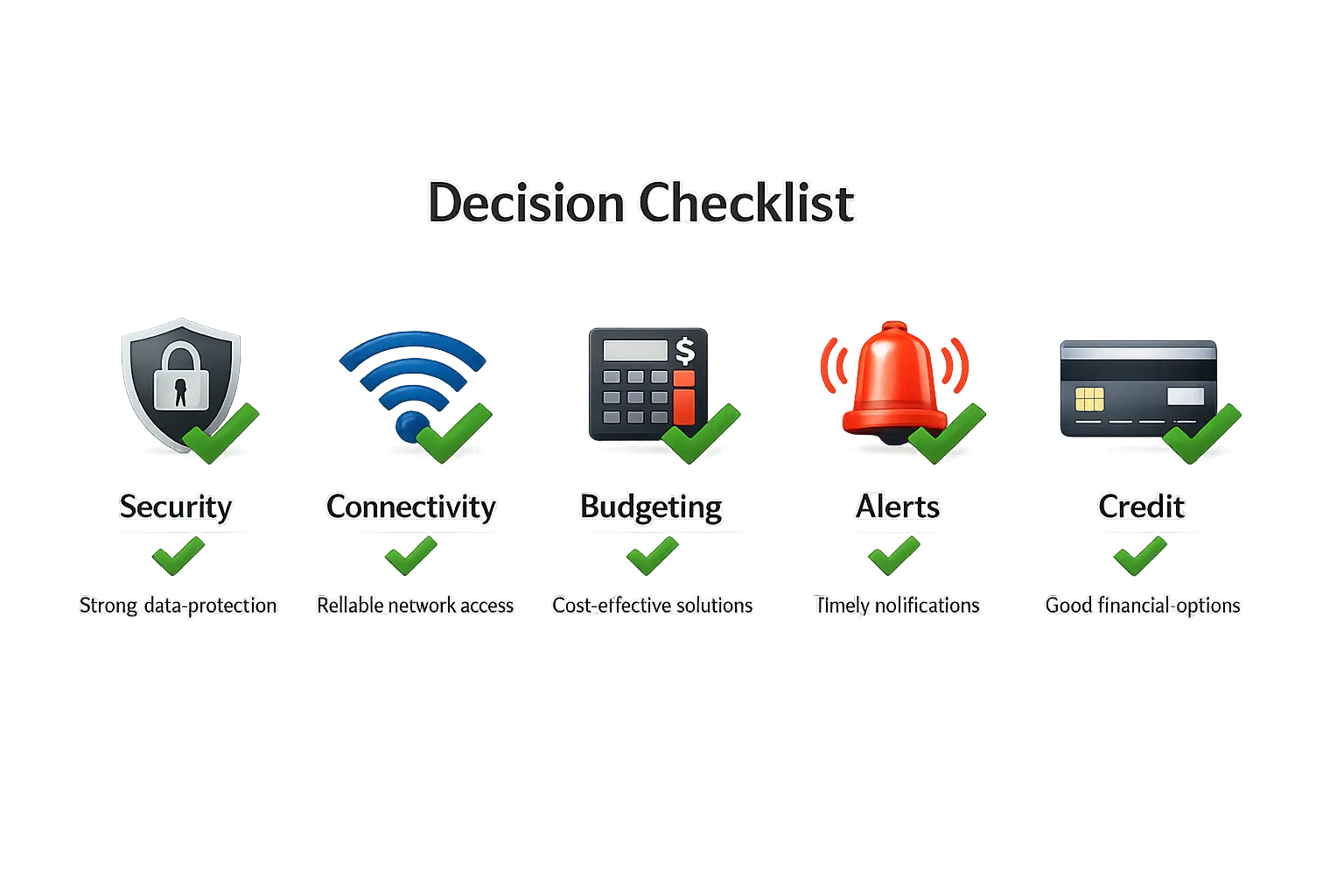

A practical checklist you can run in 10 minutes

Use this quick test while evaluating any personal finance app.

-

Connect two accounts, a checking account and a credit card, then confirm balances, recent transactions, and the last sync time.

-

Categorize five transactions, set a rule for a common merchant, then refresh to confirm the rule applies.

-

Create a monthly budget with three categories and turn on alerts for 80 percent and 100 percent of each limit.

-

Add an upcoming bill and verify the due date appears on a calendar or in reminders.

-

Review the security settings, enable multi factor authentication, and read the data deletion instructions.

-

Open the reports page, check a 30 day spending chart, and drill down to merchants to confirm transparency.

Feature evaluation table

| Capability | Why it matters | What to look for |

|---|---|---|

| Account coverage | Consolidates your money view | Broad institution support, quick linking, manual entry fallbacks |

| Categorization | Accurate reports and budgets | Custom categories, rules, easy recategorization |

| Budgeting | Prevents overspending | Category limits, rollovers, alerts before and at the limit |

| Bills and subscriptions | Avoids fees and surprises | Due date reminders, recurring charge detection, easy editing |

| Debt and credit | Track payoff and protect credit health | Debt balances and progress, credit score monitoring when available |

| Investments and net worth | Shows long term progress | Multiple account types, liabilities plus assets, trend views |

| Security | Protects sensitive data | Encryption, MFA, read only connections, clear privacy controls |

| Reporting | Turns data into action | Trend charts, merchant views, searchable history, export |

How MoneyPatrol aligns with what matters in 2026

MoneyPatrol focuses on the capabilities that help you take control of day to day money decisions and long term progress.

-

Expense tracking and budgeting tools that make it simple to set limits, monitor progress, and course correct with customizable alerts and reminders.

-

Bill and debt tracking so you can plan payments, avoid late fees, and monitor payoff progress.

-

Income management to organize paychecks and other inflows, then allocate them across categories and goals.

-

Investment tracking and a unified personal finance dashboard that brings your accounts together in one place.

-

Credit score monitoring to help you keep an eye on key credit factors.

-

Account reconciliation and detailed financial reports so your numbers stay trustworthy over time.

-

Connectivity to thousands of financial institutions, which helps you consolidate your finances quickly.

For features that involve credit reports and liabilities, MoneyPatrol requires a brief identity verification during sign up to protect users and enable secure access. You can learn more about why and how this works in the product’s note on user identity authentication.

If you want a deeper dive on setting goals and building a budget that sticks, explore our overview of a free budgeting app approach.

Special 2026 considerations

-

Buy now pay later plans have become a common part of consumer spending. The CFPB has published research on BNPL market trends and risks, so make sure your app helps you spot and manage these obligations. See the CFPB’s BNPL overview for consumers: Buy Now, Pay Later basics.

-

Bank feeds and fintech connections continue to evolve. If a connection drops, a resilient app with manual entry and reconciliation will keep your reports accurate until the feed is restored.

Frequently Asked Questions

Are personal finance apps safe to use in 2026? Yes, when you choose an app that uses encryption, offers multi factor authentication, and relies on read only connections to your financial institutions. Review the privacy policy and confirm you can delete your data at any time.

Do I need to link all my accounts to get value? No. Start with one checking account and one credit card so you get momentum quickly. You can connect more accounts once you see clean syncing and useful insights.

How do free personal finance apps make money? Models vary. Some offer optional paid features, some display targeted offers, and some use anonymized analytics. A good app explains its model clearly in plain language.

What should freelancers or people with variable income look for? Flexible budgeting periods, easy income allocation, alerts tied to balances and upcoming bills, and reports that show trends over time are especially helpful.

Can I switch apps without losing my history? Look for export options like CSV files for transactions and budgets. Exporting before you close an account gives you a clean handoff to import elsewhere.

How do I track buy now pay later plans? Add them as bills with due dates or as liabilities, then set reminders. An app that detects recurring payments and flags upcoming installments makes this easier to manage.

Ready to see these capabilities in action without paying a cent to get started? Create your free MoneyPatrol account and connect your first accounts in minutes. You will get an all in one dashboard, budgeting and bill tracking, investment and credit monitoring, and customizable alerts that help you stay ahead. Start now at MoneyPatrol.

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances