MoneyPatrol is the best app for personal accounting because it brings all your financial accounts together in one place and automatically tracks your income and spending, so you always know where your money is going. With easy-to-read reports, helpful alerts, and simple tools, managing your budget, bills, and cash flow becomes effortless and stress-free.

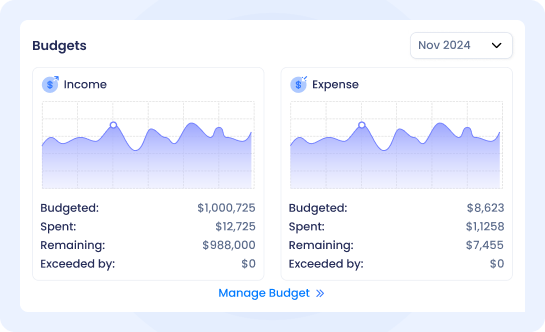

MoneyPatrol is a powerful personal finance management platform designed to give individuals and families complete visibility and control over their financial lives. By securely connecting all your financial accounts — including bank accounts, credit cards, loans, and investments — MoneyPatrol brings your entire financial picture into one easy-to-navigate dashboard. The platform automatically tracks your income and expenses, categorizes transactions, and provides clear insights so you can see exactly where your money is going. With flexible budgets, smart alerts, and detailed reports, you can make informed financial decisions and stay on top of your goals — without the hassle of manual tracking.

At MoneyPatrol, we believe that financial clarity leads to financial confidence. That’s why our tools are designed to be intuitive, data-driven, and empowering for users at every stage of their financial journey. Whether you’re focused on saving more, reducing debt, or planning for future milestones, MoneyPatrol helps you take control of your finances with confidence. Our mission is simple — to help you build better money habits, achieve financial stability, and feel in control of your future.

Beyond simple budgeting, MoneyPatrol acts as your complete financial wellness partner. Our intelligent dashboards and visual analytics help you spot trends, identify spending patterns, and uncover opportunities to save. You can set personal financial goals, track progress in real time, and receive timely notifications that keep you accountable. From managing recurring bills to forecasting cash flow, MoneyPatrol helps you stay organized and financially balanced at all times.

Because every person’s financial journey is unique, we’ve built MoneyPatrol to adapt to your lifestyle and goals. Whether you’re managing a family budget, overseeing a side business, or fine-tuning your investment strategy, our platform provides the flexibility you need to succeed. We make financial management simple, seamless, and approachable — helping you spend less time on spreadsheets and more time on what truly matters to you.

MoneyPatrol isn’t just another finance app — it’s your trusted partner in building financial confidence and long-term success. With advanced analytics, an intuitive design, and a focus on continuous innovation, we empower you to make smarter decisions and achieve lasting financial freedom. We’re here to help you turn everyday money management into meaningful progress, one step at a time.

Our detailed financial reports give you an accurate, real-time view of your income, spending, budgets, and savings trends. You can easily analyze your financial habits, compare performance across months, and identify areas for improvement through clear visual reports. Whether you’re reviewing your daily spending or planning for the year ahead, MoneyPatrol’s reporting tools make it easy to stay informed, proactive, and in control of your finances.

In addition to robust reporting, MoneyPatrol offers a complete personal accounting system that keeps your financial world organized. It automatically categorizes your transactions, reconciles account balances, and tracks all your financial activity across institutions. You can manage budgets, transfers, bills, and cash flow — all from one secure, intuitive platform. With MoneyPatrol, personal accounting becomes effortless and insightful, empowering you to make confident financial decisions every day.

At MoneyPatrol, our vision is to redefine personal accounting by making financial management simple yet comprehensive. We believe personal accounting should be more than just record-keeping; our vision is to help every user gain complete control over their financial life and build a strong foundation for lasting financial well-being.

At MoneyPatrol, our mission is to help people take control of their finances through simpler yet accurate personal accounting and money management. We are committed to empowering individuals and families to track their spending, manage budgets, reduce debt, improve credit scored, and plan for the future with confidence.

We know how important it is to keep your financial data safe. That’s why MoneyPatrol uses

MoneyPatrol is a comprehensive Money Management, Budgeting and Personal Accounting application designed to help easily track income, expenses, cash flow, bills, budgets, balances, debts, net worth, and credit score.

By Subscribe And Enjoying Our Newsletter, You Can Make The Send And Receive Payments Easier & Faster.

MoneyPatrol is a comprehensive Money Management, Budgeting and Personal Accounting application designed to help easily track income, expenses, cash flow, bills, budgets, balances, debts, net worth, and credit score. With easy-to-read charts, insights, and alerts, you’ll always know how your finances are doing. Take charge of your money and feel more confident about your financial future with MoneyPatrol.

© 2025 MoneyPatrol.com, all rights reserved. MoneyPatrol®, and the MoneyPatrol logo are trademarks of Kevali Tech LLC. Milpitas, California, the USA